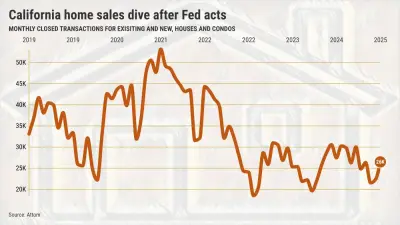

29% fewer California homes sold. Is the Fed to blame?

California homebuying hasn t been the same since the Federal Reserve s war on inflation began three years ago That s what my trusty spreadsheet located in the March homebuying statement from Attom which tracks the closed sales of existing residences and new construction both houses and condos dating to The Fed s efforts to cool an overheated financial sector with pricier financing began in March It totally iced home sales For example March s sales were the third-smallest total for the month since It s also below the month s -year average Or take a longer-term view of the collapse of homebuying In the months since the Fed started its cost-of-living focus California residences were sold in the average month vs in - We re talking a dive that s also slower than the -year average The price is wrong When the pandemic upended the business setting the Fed came to the rescue with cheap money and home prices surged Then numerous stimulus efforts and supply shortages boosted inflation to a four-decade high The central bank ended its cheap money party and yet home prices did not reverse Contemplate that California s median selling price in March was only short of the record set in May Prices have risen over months part of a jump in the last six years Mortgage mania The Fed s move to raise interest rates helped to explode a house hunter s costs In the three years of the central bank s inflation battle California home prices rose as mortgage rates soared to from creating a boost to a buyer s estimated house payments Contrast that to the three previous years when pandemic-spun rates gyrated from to historically low back to Home prices rose with only a payment jump Who can afford this Rising home prices aren t a sign of domain strength They re the reason why homebuying is frozen Over six years a California buyer s typical mortgage check is bigger In that same period there was only a increase in California wages So what would it take to close the affordability gap Try price cuts mortgages or pay hikes Or a mix of the trio Then eyeball the budget-busting fallout this way Only of California households could qualify to buy in s first quarter according to calculations from the California Association of Realtors Six years earlier this affordability yardstick indicated could buy And this qualification measure has averaged since Jonathan Lansner is the business columnist for the Southern California News Group He can be reached at jlansner scng com Related Articles Seven tactics Trump s tax and spending bill could affect Californians Here s where the money Meta spent on its billion pledge for affordable housing has gone Southern California home prices rise even as buying sputters Three-bedroom home sells in Dublin for million Single family residence sells in Pleasanton for million